Amidst the blustering weather of this October, some currents were shifting within the CTV climate to match.

We saw top-spending industries gravitate further toward Paramount+ from the month prior while others pulled away. And one in particular made a run for that number-one slot for the first time in two quarters.

Top platforms

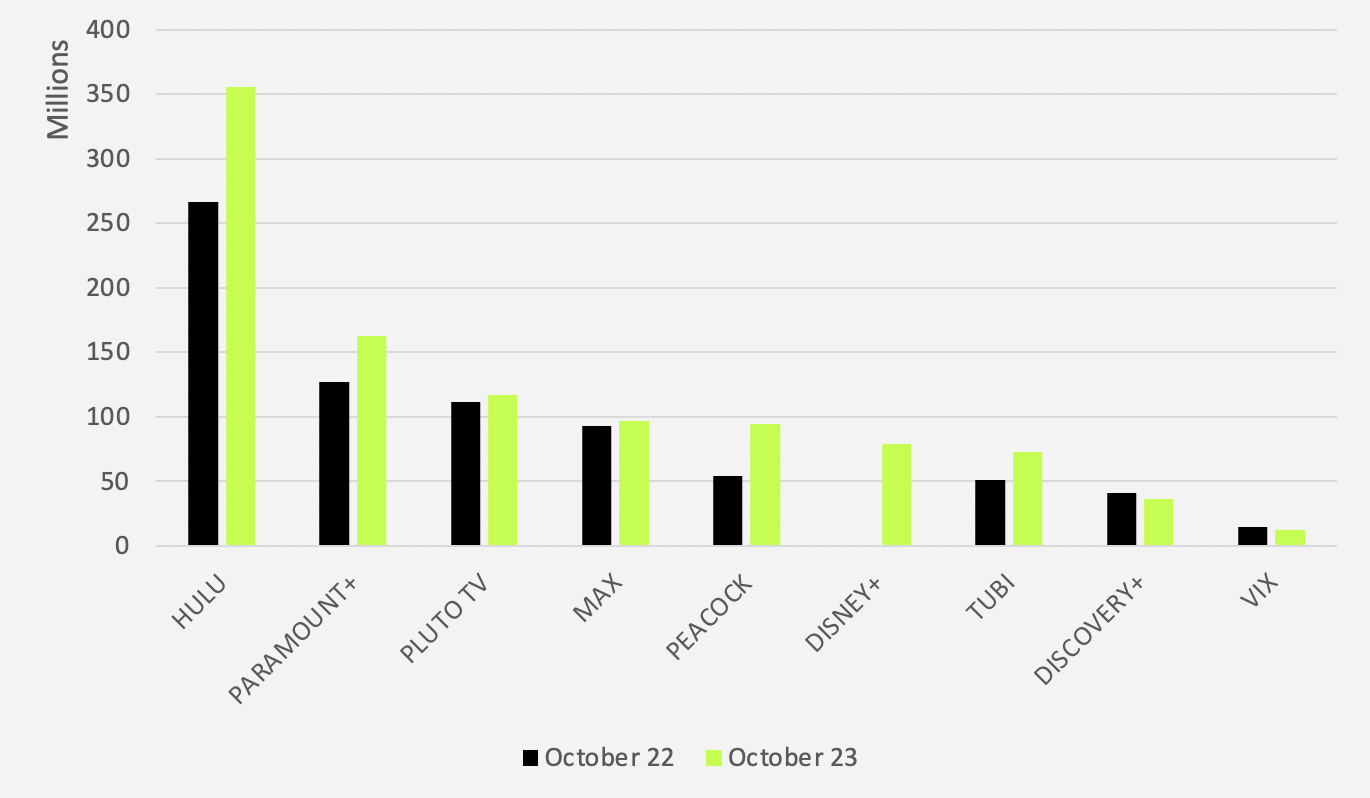

Year-over-year spend increased at the lowest rate we’ve seen in any month of 2023 when discounting Disney+—25%—but we also hit the highest grand total spend we’ve seen thus far—$1.03B.

We saw decreases in spend from 2022 for both Discovery+ and Vix in October, at rates of 10.5% and 12.7%, respectively, and a decrease of 6% from September to October for Discovery+. We also saw a 7% decrease month-over for MAX.

However, overall spend across our top nine platforms increased by 1.5% month-over-month, with a 2.4% increase for Paramount+.

October 2022-2023: Ad spend by platform YOY

Source: Vivvix

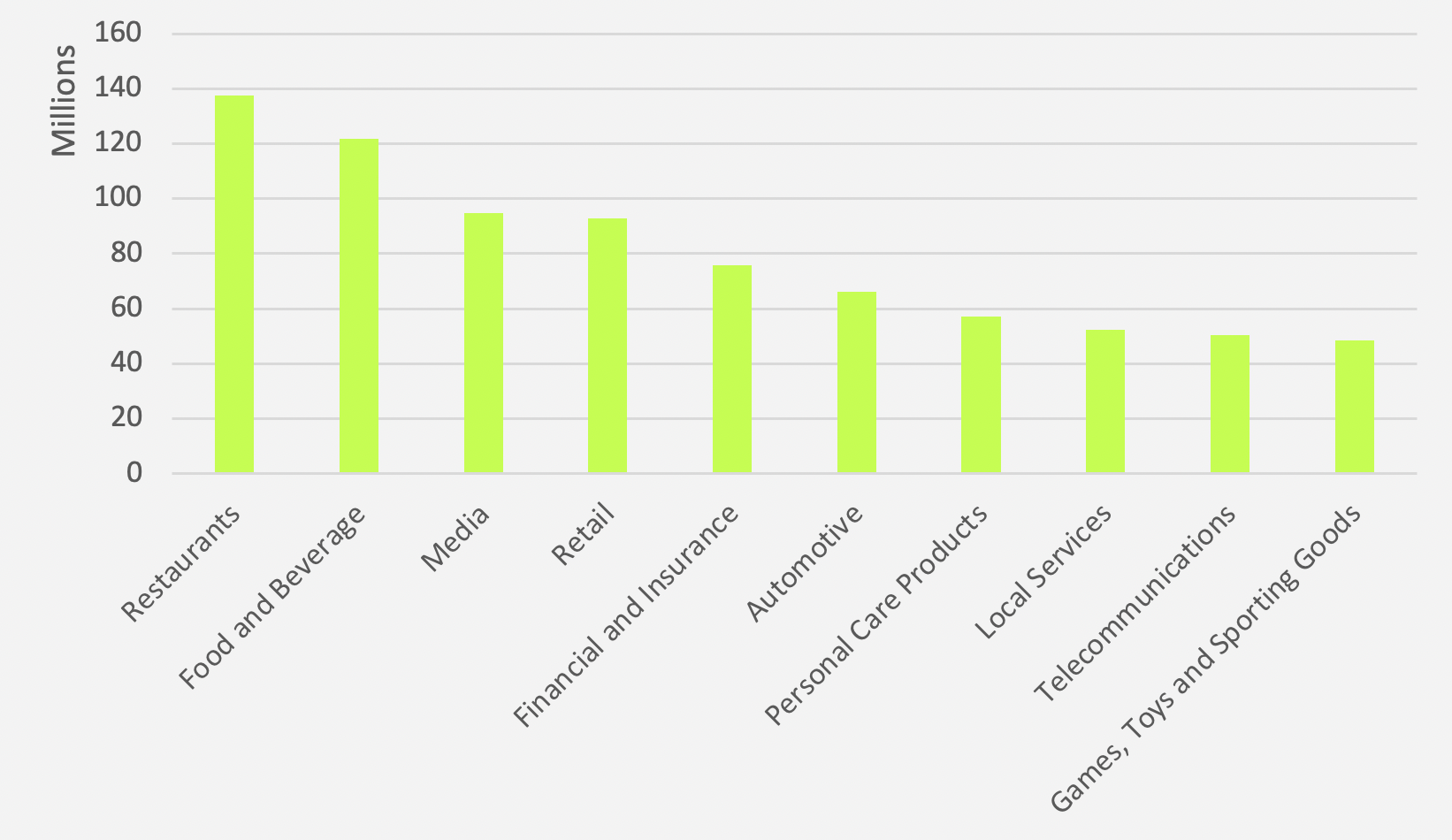

Leading industries

2. Food and beverage

3. Media

Restaurants made a comeback, reaching the top-spend spot for the first time since April with a 34% increase over September to the tune of almost $35M. Advertisers in the category invested more in Paramount+ this time around—120% or $18M more.

Food and beverage may have been surpassed, but we still saw an increase of 7% in month-over-month spend for the industry, or $8M. Another increase in Paramount+ investment accounted for about $6.5M of that additional dedication.

And the provisional Paramount+ pattern continued. Total retail spend increased by 18%—about $14M—and $5M defined the incline from September to October expenditure on the Paramount+ platform alone.

Media spend increased by 5% or $4.6M as advertisers opted for a greater investment in Hulu month-over-month. Industry allocation to Hulu rose $5.6M—even greater than the total industry increase.

- Restaurants reached the top spot with 34% more total spend in October than September and 120% more on Paramount+

- Despite falling behind restaurants, food and beverage spend increased by 7% month-over-month with an extra $6.5M toward Paramount+

- Retail spend increased by 18% and media spend increased by 5%

October 2023: Industry rankings

Source: Vivvix

Top spenders

1. Burger King

2. Amazon

3. T-Mobile

Burger King bested September top-spender McDonald’s in October, catapulting from the 14th to first slot. Their investment was up nearly 1,000% on—you guessed it—Paramount+ month-over-month, but their Pluto TV spend saw an even more gargantuan jump of 2,326% or $6.7M.

Source: Vivvix

Source: Vivvix

As for McDonald’s, the competitor fell into the fourth slot despite spending a nearly identical figure to September’s, investing roughly the same amounts in the same places.

Amazon made a similar but more conservative play, upping spend on Hulu by 271% and Paramount+ by 179%.

Chipotle cracked our top 20 for the first time this year—opting not to spend on Pluto TV, Tubi, and Vix. So did Reese’s, the only candy brand in our mix (surprised?)—investing less than one million everywhere but Hulu, which claimed 67% of their total spend.

- Burger King’s spend landed them in first after ranking 14th in September

- Amazon increased Hulu spend by 271% and Paramount+ spend by 179%

- Chipotle entered the top 20

- Reese’s spent 67% of their total on Hulu

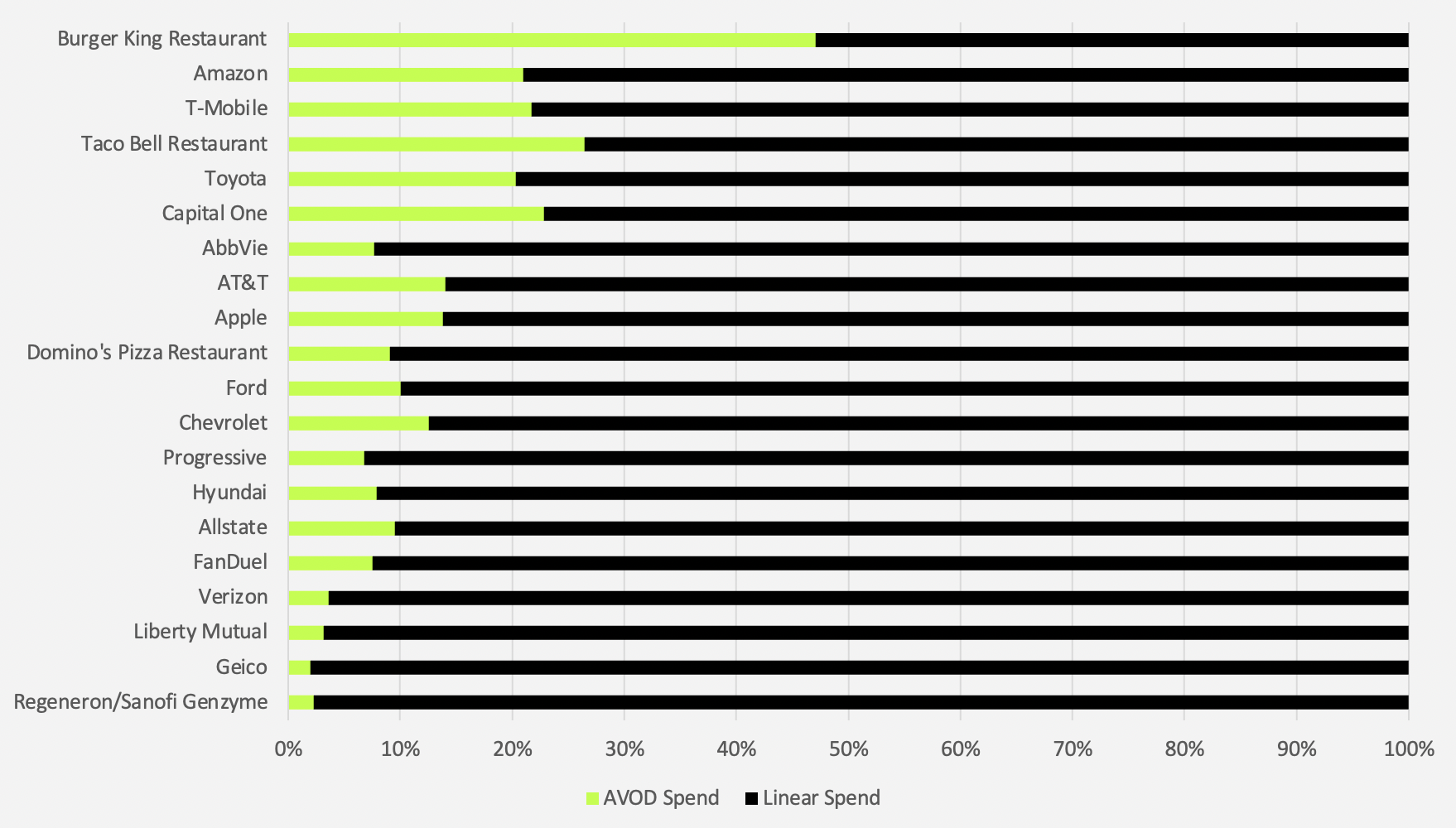

Streaming vs. linear

We also found Burger King at the top of our combined AVOD/linear spenders list in October, dedicating close to half of those dollars to AVOD.

Taco Bell put 36% of their total on AVOD, and Capital One followed close behind with 30%.

AbbVie backed off AVOD marginally—spending 16% on our top nine platforms in September, then just 8% in October.

And Chevrolet decreased their percentage of AVOD spend too—from 24% to 14%.

October 2023: Top 20 brands with highest combined streaming and linear spend (ranked from most to least in AVOD spend)

Source: Vivvix

Where's the white space?

Automotive fell from the third slot to the sixth with a spend decrease of 28% from September. Advertisers in the industry spent 60% less on MAX, about 54% less on Paramount+ and 26% less on Hulu despite upping their investments in Tubi, Discovery+, and Vix.

Still, we know that less cash flew toward Discovery+ and MAX overall. Retail advertisers, for example, allocated 67% less to Discovery+ in October than in September, and financial and insurance and travel and tourism advertisers put 40% and 48% less on MAX, respectively.

Despite the multitude of Paramount+ gains, there were still industries that scaled back on the platform month-over-month as automotive did—at even starker rates. Advertisers in the non-Rx remedies category spent 71% less on the platform while electronics advertisers spent almost 90% less there.

What trends will the holidays bring for our CTV analysis? Tune back in next month as sales roll in and brands show out.

CTV/STREAMING INTEL

Each month, we’ll share the latest insights including spend, trends, and creative in one of the most competitive landscapes to date. Stay tuned as we #FreeTheData.

Want access to streaming data and breaking creatives? Contact us here.

.png?width=160&height=72&name=Vivvix-Logo-Horizontal-Green%20(1).png)

-2.png?width=162&height=72&name=go.vivvix.comhs-fshubfs_NewCoVivvix-Logo-Horizontal-Green%20(1)-2.png)