As predicted, overall spend across our top nine platforms topped one billion dollars again—a testament to seasonality as advertisers began ramping up their CTV efforts in pursuit of a bountiful holiday harvest.

As always, we’re examining where those dollars went as fall began, but we’ve taken a particular interest in one resilient platform that’s making another comeback.

Top platforms

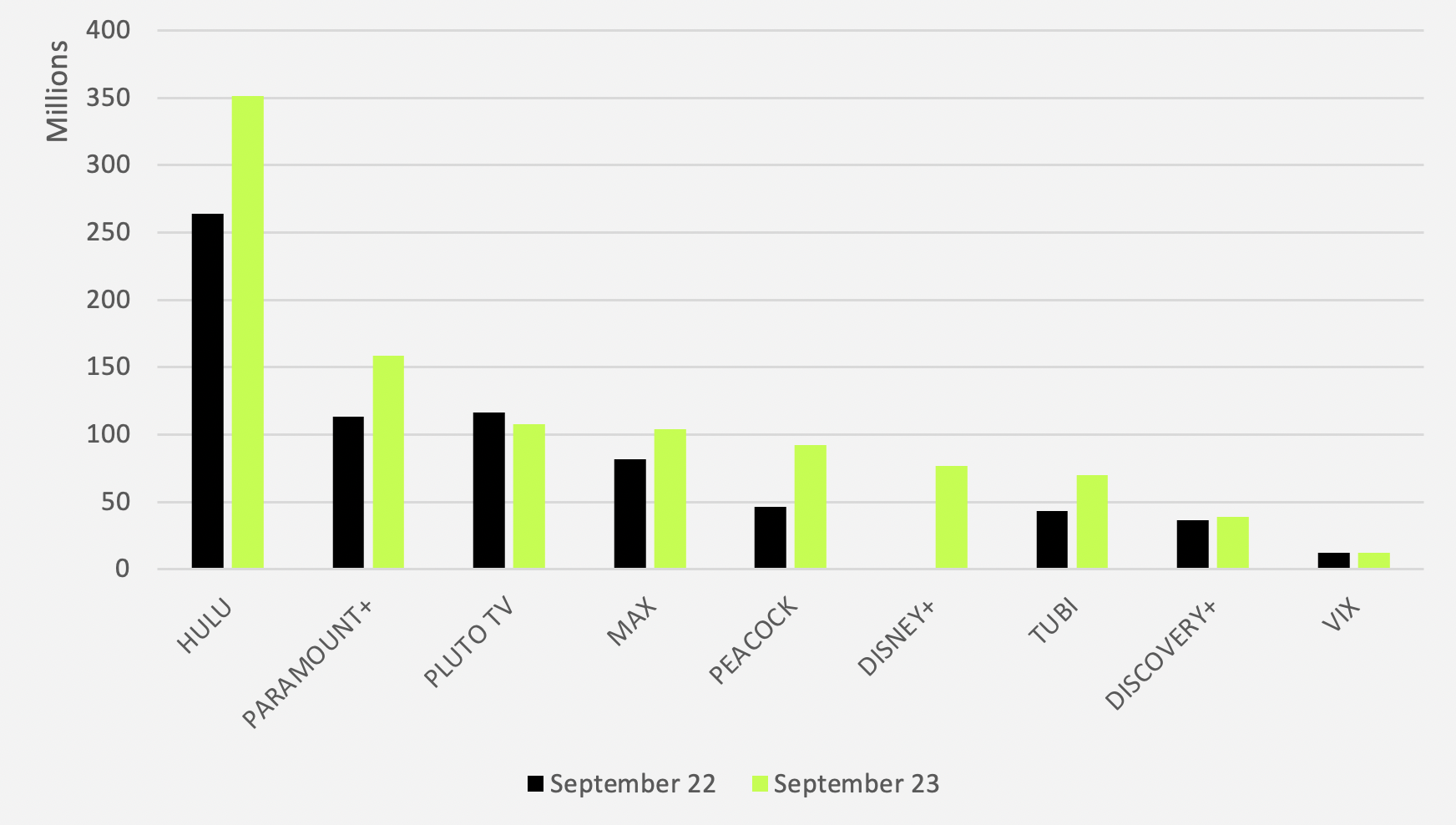

September’s $21.6M month-over-month increase in overall CTV spend is primarily attributable to the fact that Pluto TV spend was up $13.7M from August, pushing the platform into the third spot once again.

While Paramount+ has been parked in second for three months in a row—the slot below has proved to be quite a dynamic space as Pluto TV, MAX and Peacock have taken turns sliding into the rank to keep us on our toes.

September 2022-2023: Ad spend by platform YOY

Source: Vivvix

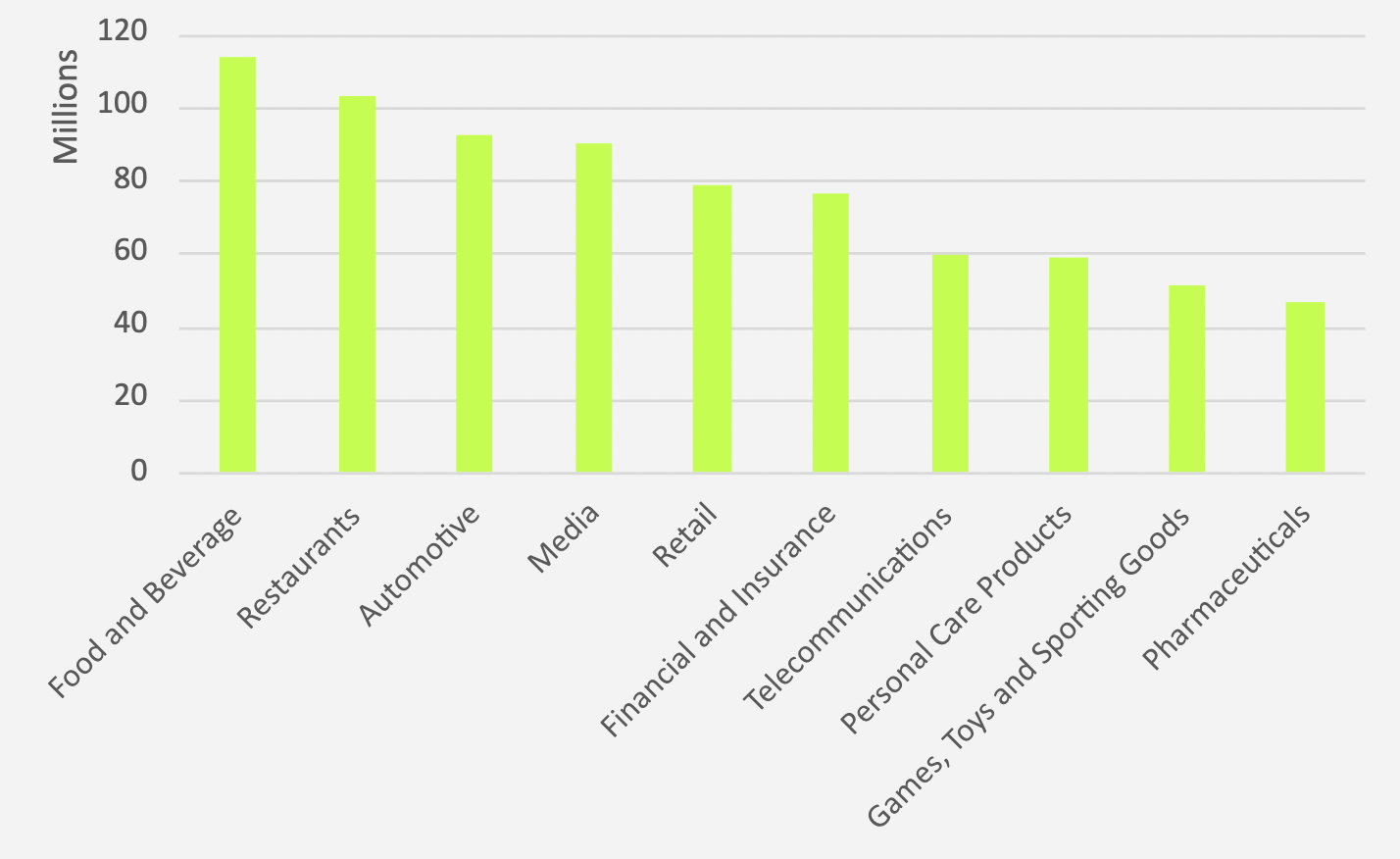

Leading industries

2. Restaurants

3. Automotive

Games, toys and sporting goods entered our top 10 industries with the highest CTV spend. The total was $51M—double that of the industry’s August spend.

Personal care products spend also soared month-over-month with an additional $16M toward our top nine platforms, bringing the September total to $59M.

To fulfil the promise we made last month, we’ll take another look at Pluto TV spend to announce the industries that sent the platform on an upward trajectory into September.

The update is—as you would imagine—most did.

Notably, though, restaurants made waves with a dedication of $12M more than the previous month, and games, toys and sporting goods went for $9.5M more.

- Games, toys and sporting goods overall spend doubled from August to $51M

- Personal care products spend was $59M

- Most industries spent more on Pluto TV than in August, especially restaurants and games, toys and sporting goods

September 2023: Industry rankings

Source: Vivvix

Top spenders

1. McDonald's

2. AbbVie

3. State Farm

McDonald’s upped their total CTV spend by nearly $4M from August to September. While Hulu’s slice of their pie shrunk from 65% to 26%, Pluto TV’s grew from less than 1% to 29%.

Source: Vivvix

Source: Vivvix

AbbVie nearly doubled their CTV spend in that period—the reason being that they doubled their investment in Paramount+. 81% of their CTV dollars went to the platform.

State Farm placed 31.5% of their budget on MAX while less than 1% went to Pluto TV.

Amazon cut spend yet again, decreasing their overall investment by just about $5M month-over-month. They rolled it back evenly across all of the platforms they’d chosen in August.

Taco Bell and Burger King took a great interest in Hulu, putting more of their money into the platform than any other. Little Caesar’s did not, but they did rank second in Pluto TV spend amongst our top 20 despite ranking sixth overall.

Monopoly Go emerged as a top CTV advertiser in the 10th slot, favoring MAX and Pluto TV almost equally.

- McDonald’s allocated 29% of their total CTV spend to Pluto TV

- Amazon cut spend by $5M month-over-month

- Monopoly Go became a top 10 advertiser, favoring MAX and Pluto TV

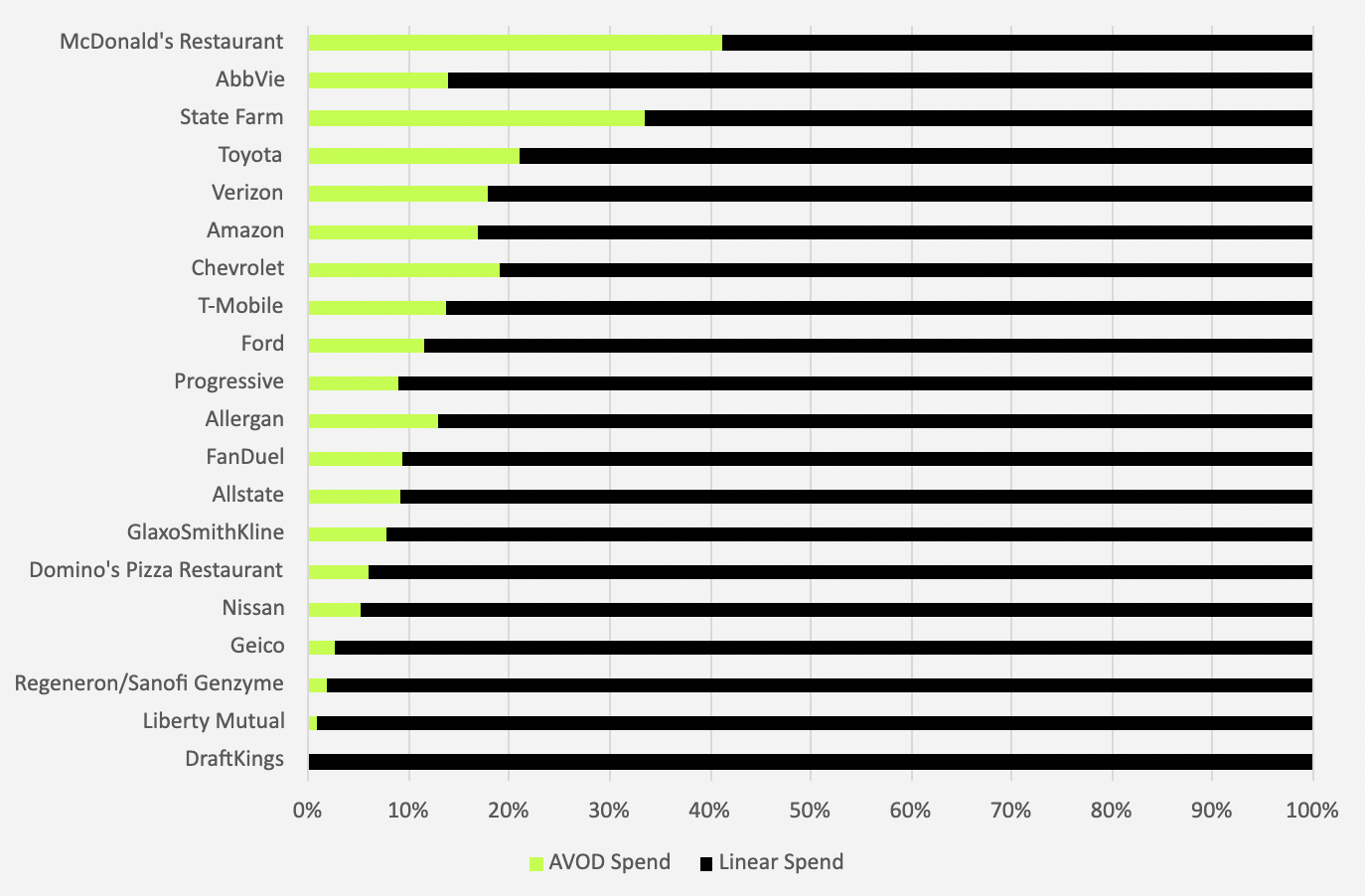

Streaming vs. linear

AbbVie has been the top combined AVOD/linear advertiser for eight months running, and they upped their investment by more than $11M from August to September, the majority of which went to AVOD.

September’s chart actually depicts a pattern we haven’t seen so pronouncedly thus far in 2023—with the glaring exception of the pharmaceutical company. It’s beginning to shape up like the higher the AVOD spend, the greater the percentage of AVOD/linear spend going to the former.

September 2023: Top 20 brands with highest combined streaming and linear spend (ranked from most to least in AVOD spend)

Source: Vivvix

That trend aside, State Farm dedicated the second-highest percentage to AVOD of any advertiser, and they upped their total spend across the two media types by more than $13M.

They ranked second after setting a record for greatest contribution toward AVOD in a monthly AVOD/linear split in August with 68%, however, because those added dollars went toward linear.

Ford increased their overall total by almost 114%, but the same was true for the auto manufacturer—the addition went to linear.

- AbbVie upped their AVOD/linear spend by $11M from August, spending most of those additional funds on AVOD

- State Farm spent $13M more, but the added dollars went toward linear

- Ford increased their overall total by 114%, but most of the increase went to linear

Where's the white space?

Advertisers within our top 10 industries did, in fact, return to Pluto TV, bumping up their investments this September over the previous month—but not in every case.

Financial and insurance spend on the platform dipped from $15M in August to $6.7M in September, and retail spend dipped from $8.6M to $3.3M.

Food and beverage spend on Pluto TV may have increased, but overall industry spend across platforms decreased quite a bit—by more than $14M.

Overall financial and insurance spend also dropped—by $16M.

Lastly, electronics advertisers backed off MAX as the industry’s spend decreased by nearly 72%. The automotive industry saw a similar trend with a reduction of 53%.

All things considered—we know that the one constant in this game is change.

Advertisers in any given industry may jump in to fill these gaps next month. And when they do, we’ll be sure to let you know.

CTV/STREAMING INTEL

Each month, we’ll share the latest insights including spend, trends, and creative in one of the most competitive landscapes to date. Stay tuned as we #FreeTheData.

Want access to streaming data and breaking creatives? Contact us here.

.png?width=160&height=72&name=Vivvix-Logo-Horizontal-Green%20(1).png)

-2.png?width=162&height=72&name=go.vivvix.comhs-fshubfs_NewCoVivvix-Logo-Horizontal-Green%20(1)-2.png)